The American Prosperity Card Act: Reclaim Your Share of America’s Debt

In 17 pages, the American Prosperity Card Act ends the $240–260 billion annual skim banks take from your deposits and swipes—redirecting it as direct Treasury yields to every adult citizen. No new taxes. No CBDC. Just your money earning what it should: the full risk-free rate. Backed by open-source models showing 0.4–1.4% GDP boosts in simulations. Ready for Congress in 2026.

Three Simple Changes to Fix a Broken System

The American Prosperity Card Act reframes U.S. debt from a burden to a citizen asset. Here’s how:

1. Free Treasury-Backed Debit Card for Every Adult

- Every U.S. adult (18+) gets a fee-free debit card.

- Deposits (paychecks, refunds) auto-buy short-term Treasuries in your name, earning the full ~4.5% yield (paid monthly).

- Spend like any debit card—no overdraft, ATM, or monthly fees.

2. Cap Swipe Fees, Unlock the Prosperity Fund

- Caps debit interchange at Walmart’s rate: 0.05% + $0.21 per transaction (saves ~$160–180B/year today).

- Reclaims bank deposit-Treasury spreads (~$55–65B/year).

- Total fund: ~$215–245B annually—50% expands Child Tax Credits/EITC, 50% retires national debt.

3. Citizens First on New Treasury Debt

- Up to 50% of new debt issuance prioritized for citizens (non-competitive, at-market rates).

- Reduces foreign holdings (currently ~50%), stabilizes funding, and turns interest into household dividends.

- Long-term: All debt becomes citizen-owned.

Sources: Federal Reserve Payment Study 2024; U.S. Treasury yields as of Dec 2025.

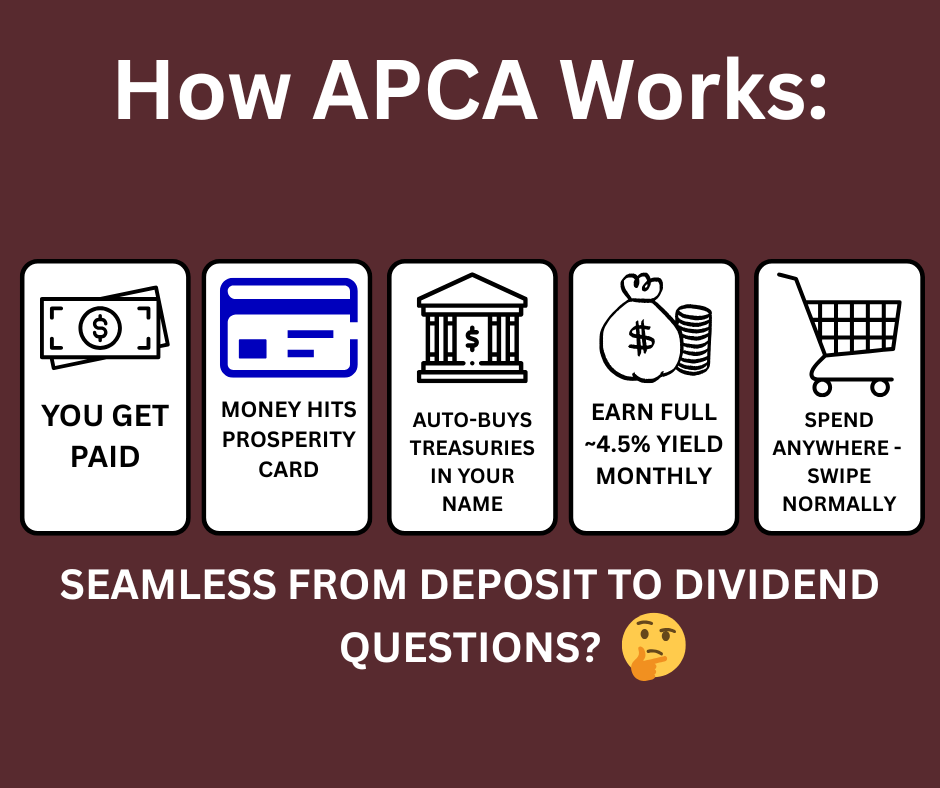

How the Card Works: From Deposit to Dividend

No apps to download, no accounts to open—it’s seamless, using existing TreasuryDirect rails.

- Get Your Card: Issued free via tax refund or application; opt-in for all adults.

- Deposit Funds: Paycheck hits? It auto-buys T-bills in your name (no bank intermediary).

- Earn Yield: Full Treasury rate (~4.5%) compounds monthly—e.g., $5K balance = ~$190/year extra.

- Spend Freely: Swipe for groceries; funds redeem instantly from your T-bills.

- Fund Grows: Swipe caps + spreads fill the Prosperity Fund, boosting your EITC/CTC checks.

Footnote: “Non-competitive basis” means citizens buy at face value without bidding wars—plain priority access.

Built-in Safeguards: No Risks, All Rewards

The bill anticipates every concern—explicitly banning overreach while protecting users and banks.

- Not a CBDC: $50K penalties for mislabeling; runs on private bank rails or TreasuryDirect only.

- Bank-Friendly: Private banks service for 0.1% fee; community banks/credit unions get priority.

- Fund Lock: Raids require 2/3 congressional vote; off-budget, untouchable.

- Privacy First: No surveillance; data shielded from government or corporate misuse.

Philosophy: Debt interest is a citizen dividend, not a bank subsidy.

Economic Impact — Backtested Across Three Eras

Conservative 50% uptake. Numbers update live with current Treasury yields.

| Scenario | Uptake | Annual Fund | GDP Boost | Debt Retired |

|---|---|---|---|---|

| 2008–2009 Crisis | 50% | $60 B | 0.4 – 0.5% | $30 B |

| 2019 Expansion | 50% | $145 B | ~1.4% | $72 B |

| 2025 Today | 50% | $240 – $260 B | 1.7 – 2.0% | $120 – $130 B |

# American Prosperity Card Act Economic Model (v3.0.0 Final)

# Todd Schaefer | December 2025 | MIT License

import pandas as pd

household_deposits = 13_800_000_000_000

tbill_rate = 0.038

savings_rate = 0.0061

interchange_fees_total = 187_000_000_000

atm_fees_total = 7_500_000_000

fdic_ncua_premium_rate = 0.00033

total_potential_recapture = (

household_deposits * (tbill_rate - savings_rate) +

interchange_fees_total + atm_fees_total +

household_deposits * fdic_ncua_premium_rate

)

scenarios = { ... } # Full code continues — scroll ↓

# === CURRENT ECONOMIC PARAMETERS (aligned with bill Sec. 2) ===

household_deposits = 13_800_000_000_000 # $13.8T household deposits (2025)

tbill_rate = 0.038 # ~3.8% short-term Treasury yield

savings_rate = 0.0061 # Average bank savings rate 0.61%

interchange_fees_total = 187_000_000_000 # Annual interchange (2025 est.)

atm_fees_total = 7_500_000_000 # Midpoint of $7–8B ATM fees

fdic_ncua_premium_rate = 0.00033 # 3.3 bps — current FDIC + future NCUA proxy

# Total hidden subsidies citizens currently forfeit every year

total_potential_recapture = (

household_deposits * (tbill_rate - savings_rate) +

interchange_fees_total + atm_fees_total +

household_deposits * fdic_ncua_premium_rate

) # ≈ $639 billion per year

# === ADOPTION SCENARIOS ===

scenarios = {

'Pessimistic': [0.10, 0.20, 0.30, 0.35, 0.38, 0.40, 0.40, 0.40, 0.40, 0.40],

'Modest': [0.25, 0.40, 0.55, 0.65, 0.72, 0.78, 0.82, 0.85, 0.87, 0.89],

'Optimistic': [0.30, 0.55, 0.75, 0.85, 0.90, 0.92, 0.93, 0.94, 0.95, 0.96],

'Lightning': [0.35, 0.70, 0.90, 0.95, 0.97, 0.98, 0.985, 0.99, 0.99, 0.99]

}

wealth_shares = {'bottom_50': 0.053, '50_90': 0.35, 'top_10': 0.597}

skewed_adoption_factors = {'bottom_50': 1.6, '50_90': 0.4, 'top_10': 0.4}

mpc = 0.8

tax_rate_on_boost = 0.20

revenue_feedback_multiplier = 1.35

years = range(2026, 2036)

marginal_debt_rate = [0.042, 0.041, 0.040, 0.038, 0.036, 0.034, 0.033, 0.032, 0.031, 0.030]

# Bank profit elasticity – banks historically earn ~3× the rate of GDP growth

current_gdp = 30_000_000_000_000 # ~$30T US GDP

current_bank_profits = 300_000_000_000 # ~$300B annual banking sector profit

bank_profit_elasticity = 3.0

# === FUND ALLOCATION (exact match to bill Sec. 5) ===

def get_allocations(uptake):

if uptake >= 0.90: admin = 0.02

elif uptake >= 0.75: admin = 0.05

elif uptake >= 0.50: admin = 0.10

else: admin = 0.20

freed = 0.20 - admin

eitc = 0.50 + 0.70 * freed

debt = 0.30 + 0.30 * freed

return eitc, debt, admin

# === MAIN SIMULATION ===

def simulate_apca(scenario, skewed=False, velocity=15):

data = []

for i, year in enumerate(years):

uptake_people = scenarios[scenario][i]

if skewed:

uptake = sum(min(1.0, uptake_people * skewed_adoption_factors[g]) * s

for g, s in wealth_shares.items())

else:

uptake = uptake_people

recaptured = total_potential_recapture * uptake

eitc, debt, admin = get_allocations(uptake)

eitc_alloc = recaptured * eitc

debt_alloc = recaptured * debt

admin_alloc = recaptured * admin

debt_savings = debt_alloc * marginal_debt_rate[i]

fdic_ncua_savings = recaptured * fdic_ncua_premium_rate

econ_boost = eitc_alloc * mpc * velocity

# Banks still win from extra GDP growth

additional_gdp_growth = econ_boost / current_gdp

anticipated_bank_profit_increase = (bank_profit_elasticity *

additional_gdp_growth * current_bank_profits)

tax_revenue = econ_boost * tax_rate_on_boost * revenue_feedback_multiplier

data.append({

'Year': year,

'Uptake': round(uptake, 3),

'Recaptured ($B)': round(recaptured / 1e9, 1),

'EITC/CTC Boost ($B)': round(eitc_alloc / 1e9, 1),

'Debt Retirement ($B)': round(debt_alloc / 1e9, 1),

'Admin ($B)': round(admin_alloc / 1e9, 1),

'Debt Interest Savings ($B)': round(debt_savings / 1e9, 1),

'FDIC+NCUA Relief to Banks/CUs ($B)': round(fdic_ncua_savings / 1e9, 1),

'Economic Boost ($B)': round(econ_boost / 1e9, 1),

'Tax Revenue Generated ($B)': round(tax_revenue / 1e9, 1),

'Anticipated Bank Profit Increase ($B)': round(anticipated_bank_profit_increase / 1e9, 1)

})

df = pd.DataFrame(data)

totals = df.sum(numeric_only=True)

totals['Year'] = 'TOTAL (10 yrs)'

df = pd.concat([df, pd.DataFrame([totals])], ignore_index=True)

return df

# Example: Modest scenario, skewed adoption, conservative velocity=5

# df = simulate_apca('Modest', skewed=True, velocity=5)

# print(df.to_markdown(index=False))

Sources: Federal Reserve 2024, FDIC, U.S. Treasury yields (Dec 2025), BLS GDP data.

Common Objections: Answered with Facts

We’ve stress-tested the bill. Here’s how it holds up.

1. Won’t this squeeze bank lending in a crisis?

No—banks create loans via balance sheets, not deposits alone. 2008 backtest: $60B household stimulus with minimal credit impact, pruning “zombie” firms for healthier growth.

2. Is rollout chaotic for 200M cards?

Optional bank participation (0.1% fee) leverages existing debit infrastructure. Refusal means deposits shift to TreasuryDirect—market-driven, no chaos.

3. Benefits uneven—savers win, poor lose?

Fee caps lower prices for all; EITC/CTC expansions target low-income (spillover even for non-users). High-wealth opt out; bottom 50% adopts fastest via familiar programs.

4. Banks raise other fees in response?

Zero-cost opt-out to the card kills that—competition forces efficiency, not gouging.

5. Overheats economy in booms?

Permanent mechanic: Boosts saving in good times, stimulus in bad. 2019 sim: 1.4% GDP, <0.3% inflation.

6. Gets repealed like other reforms?

Monthly yield “receipts” make it untouchable—self-funding at 2–5% uptake, like Social Security.

The Full Bill: 17 Pages of Precision

Short, enforceable, and ready for introduction. Key excerpt from Sec. 4 (Funding):

“Interchange fees on debit transactions shall not exceed 0.05 percent of the transaction value plus 21 cents… Excess fees shall be deposited into the Prosperity Fund for allocation under Sec. 5.”

Bill aligns with Full Faith and Credit Clause; no constitutional issues.

Make It Law: Find a Sponsor

One CBO score unlocks everything. Contact Representative or Senator Today: “Co-sponsor for $800–$1,500 extra per family.”

America’s 250th: The gift of financial sovereignty.

Leave a Reply