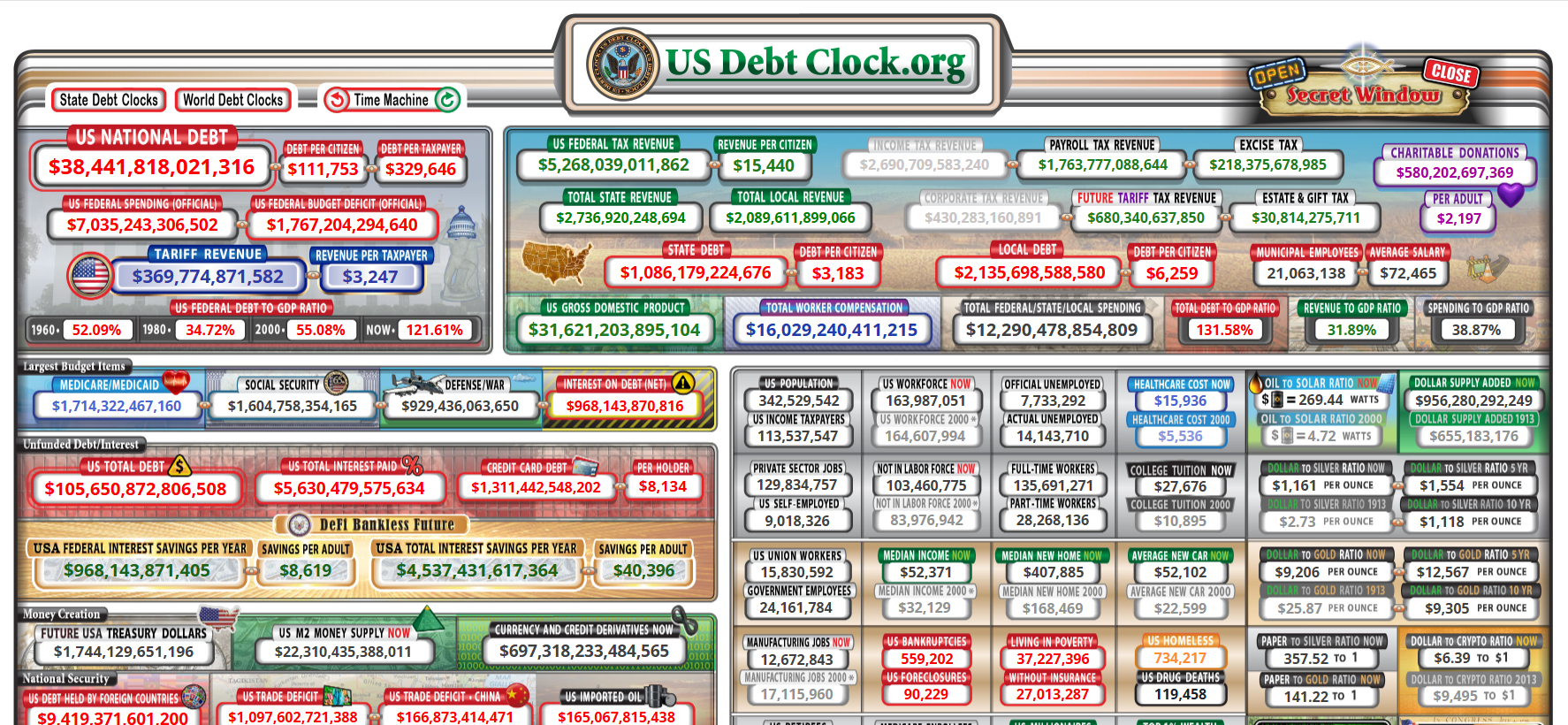

This is perhaps the most important question to dissect when discussing Fides Currency. We have all certainly heard that the National Debt is ‘out of control’ or that we are on the verge of a sovereign debt crisis. We’ve seen the US Debt Clock, as shown above, furiously ticking away. And we’ve heard countless politicians say that the only way to fix the country is to cut spending and eliminate that debt.

On February 20, 1989 the first U.S. National Debt clock was put up in Times Square when the debt was just $2.7 trillion. For four decades we have allowed the beneficiaries of that debt via our taxes that pay the interest to frame the entire debate.

First we must understand banking:

The cold hard fact is that through our deposits in private financial institutions and retirement accounts, i.e. 401(k) and TSP, we already indirectly own $20 trillion of the debt, albeit indirectly.

To understand how this is possible, let’s discuss banking. When you go to the bank and deposit money, that money is a liability on the banks balance sheet because they are responsible to give you back your money on demand therefore must keep it safe. In order to ‘limit their exposure’, they then purchase various interest bearing assets to offset that liability. That asset is in the form of various corporate bonds, issuance of loans, or the purchase of U.S. Treasuries.

Treasuries are the safest asset in the world, as they are backed by “the full faith and credit of the United States”. That accounts for $10 trillion in public deposit asset offsets via treasuries. The bank collects 4-4.5% on those treasuries, and in turn gives you .6% on average to your savings or checking account. They are profiting off of our ‘debt’ bought with our deposits. For every $100 in your bank account, the bank keeps 3%+ and you get the ‘peace of mind’ that your money is safe. What a great deal for the bank.

Retirement accounts aren’t quite as tricky. They invest your money in treasuries, again the world’s safest asset class, proportional to how you direct it or how the fund allocates their investments. If you review the TSP Lifecycle funds allocation, something may become clear. As you approach retirement age, each fund is designed to shift to lower risk and more stable assets. And the most stable asset? You already know. All retirement accounts do have servicing fees, so you still aren’t getting direct treasury yields, but you do have indirect ownership in our ‘debt’.

So how does Fides address this?

Under a fides economic model, your deposits are direct ownership in the safest ASSET on the planet. With a little legislative tweak, retirees might even be able to convert their retirement account to a treasury backed account and earn full interest with no admin or overhead costs.

No colossal shift is required in how you earn, spend, or save your money. All the model is doing is giving you the opportunity for direct ownership. Once that is understood, the choice becomes clear. We just eliminate the middle-man.

Redefining National Debt

Just like magic we’ve stopped using the language under which they have framed the debate for decades. The banks cannot create money, only we can through our government and the Treasury. They become servicers of OUR asset, as opposed to the owners of it. Calling it debt was just using their language.

Leave a Reply